2023: the year when the cost of the global indebtedness will explode

This year will be a tougher year for the global economy than 2022. For most of the world economy, this is going to be a tough year, tougher than the year we leave behind because the three big economies — US, EU, China — are all slowing down simultaneously. We expect one third of the world economy to be in recession Even countries that are not in recession, it would feel like recession for hundreds of millions of people.

Kristalina Georgieva, Director General, International Monetary Fund, January 1, 2023

This sober declaration does not leave illusions about what lies ahead for us. The slowing down and sometimes recession of the economies leaves very little to the imagination. In this context, inflation that spread around the world and the sectors in 2022 will continue to dominate the problems of the purchasing power of the population.

Why is nobody talking about the debt?

Central banks, Governments and large corporations have a vested interest to hide the facts. Christine Lagarde, the head of the European Central Bank is blaming the war in Ukraine for the inflation. Having warned in these columns and others about the risks of explosion of the world debt for the past five years, I remain flabbergasted to see that the narrative remains centered on recession and inflation. The impact of high interest rates increases of spreads and high value of the US dollar will start being felt where the over indebtedness has been exploding.

In a previous blog we analyzed the risks for emerging markets, stating that the financial crisis of those markets are unavoidable and probably massive.

However, the over indebtedness of the United States, Europe, Japan, and China could create a much more severe debt crisis, both at sovereign and at corporate levels.

The United States

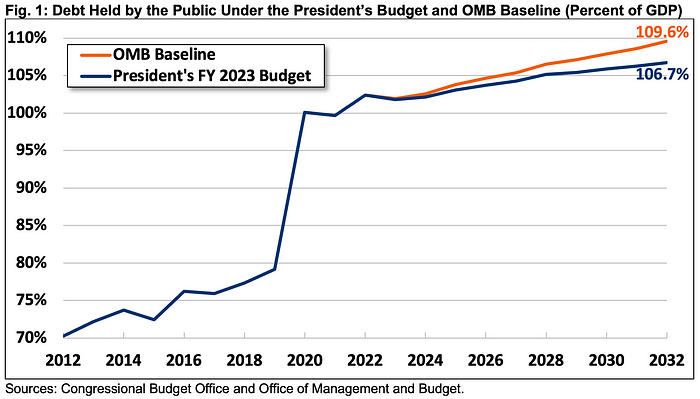

The continued increase of the US debt will have a budgetary impact in the years to come through the increase of the net interest costs that is fairly dramatic. In four years, the share of net interests to the budget deficit will move from 25 to 44%. It is basically unsustainable [1] The death of the Republican religion of fiscal conservatism started with the war in Irak.

The continued increase of the US debt will have a budgetary impact in the years to come through the increase of the net interest costs that is fairly dramatic. In four years, the share of net interests to the budget deficit will move from 25 to 44%. It is basically unsustainable.

Europe

The European Treaties were capping the EU debt to GDP at 60%. The current level is 90%, that is close to the United States, but hides the fact that it is not a pan European debt. Italy, Spain, and France largely exceed those numbers while Germany is not far away.

Even though the debt is mostly denominated in Euros, the interest rates have increased in 2022. If we just look at the increase of the long-term rates, the picture is not reassuring.[2]

The average long term interest rates has been multiplied by 4. The European Budgets will be challenged, and unsustainable unless, as it sometimes does, the EU Commission creates an exception to its own fiscal rules for “exceptional circumstances”. That would hide the failure of the ECB, but make Europe even more fragile that it is today, as it confronts the direct consequences of the War in Ukraine.

The emergence of inflation in the European Union Dec 2021-November 2022

The fact that the risk is concentrated in Southern Europe creates a dilemma that cannot be resolved without a clear view that those countries who are closest to a possible failure cannot be rescued any longer.

The interest cost of their debt is unbearable: its is time to get out of the denial.

Japan

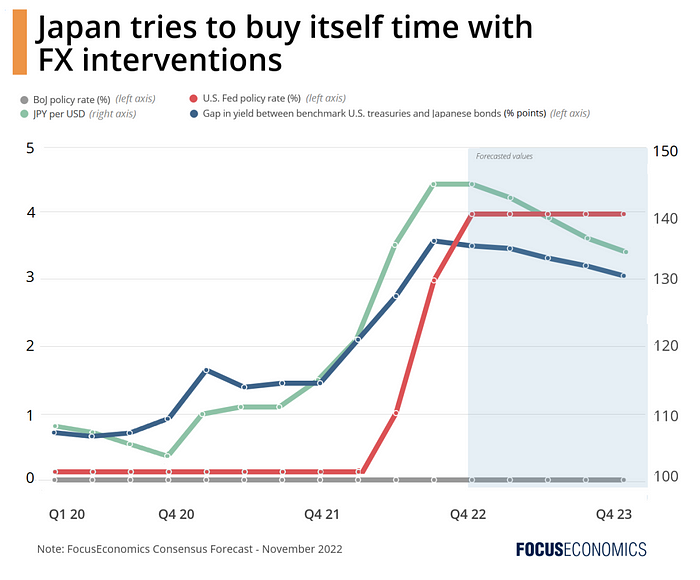

The numbers are staggering: The relative stabilization in the last few months should not hide that an average of 230% of GDP could only be possible because the interest rate was negative. The Bank of Japan has played its card by denying the increase of inflation and the huge impact that the increase of long-term rates will have on the Japanese budget deficit.

The yen fluctuation reached proportions unheard of from developed economies, going down from 100 to 150 JPY to the USD in one year to retreat today at 132. Denying an inflation that went from 0 to 3.7%, the highest rate in 40 years, was deeply misleading and the recent measures did not affect the BoJ rates. The BOJ shocked markets on December 20th with a surprise widening of the band around its 10-year yield target, a move that will allow long-term rates to rise more, while kept its key interest rate steady at -0.1%.

The dramatic stagnation of the Japanese economy will undoubtedly make the cost increase of its gigantic sovereign debt unbearable.

China

While China’s sovereign debt to GDP remains under control, at 80%, the effective leverage of the Chinese public sector reached proportions that represent 200% of the Chinese GDP. It is the speed at which the sovereign debt increased from 30% in ten years that makes China increasingly overleveraged.

However, its inflation and interest rates are stable.

The danger is in the recession provoked by the COVID lockdown of the economy and the overleverage of several sectors, in particular the Evergrande indebtedness that destabilizes the financial sustainability of the country.

This combination is also unbearable.

2023 is the year where we will start paying the cost of our inconsiderate addiction to debt.

In those four regions, the current debt situation is becoming unbearable.

It is too early to predict where from the global debt crisis will start in 2023. I would argue that, even if it is not yet the core focus of public and private sector countermeasures, it has already started.

The irresponsible resorting to debt to grow the economy could not end up well. But the impact will not stop in 2023. As reimbursements and new budget deficits (including interest costs) face realistic interest rates, albeit negative in real term, the default of a number of countries will spread over the next three years.

Economies enjoyed the privileged of Government spending for current expenses. The governments are guilty as charge. The Central Banks have delayed the return to fiscal discipline. Both are now trapped into a problem that will take a decennium to resolve itself.

We all make mistakes, and we all pay a price. But it will be deeply inequal making the coming years a huge social challenge.

[1] https://www.whitehouse.gov/wp-content/uploads/2022/03/budget_fy2023.pdf

[2] https://www.ecb.europa.eu/pub/projections/html/ecb.projections202203_ecbstaff~44f998dfd7.en.html